Strategic offshore trusts asset protection can add layers of defense to your portfolio.

Strategic offshore trusts asset protection can add layers of defense to your portfolio.

Blog Article

Exploring the Perks of Offshore Depend On Possession Protection for Your Wide Range

When it comes to protecting your wide range, offshore trusts can offer significant benefits that you could not have taken into consideration. Allow's discover what offshore counts on can do for you.

Understanding Offshore Trusts: A Guide

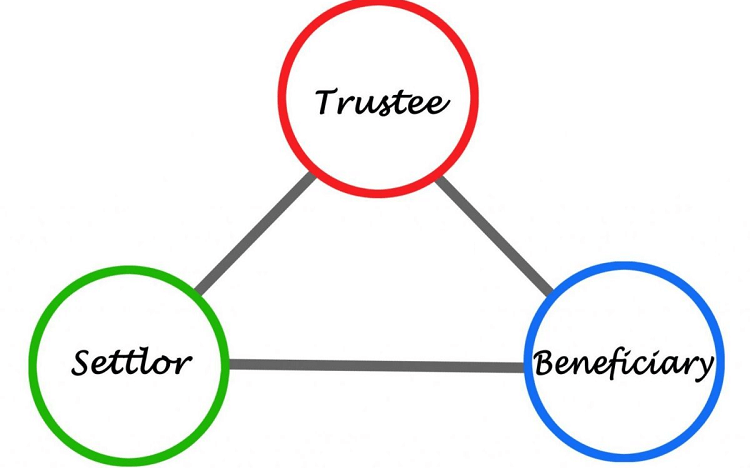

Offshore trust funds provide an one-of-a-kind way to manage and shield your possessions, and understanding their principles is essential. When you set up an offshore trust fund, you're essentially moving your properties to a trustee, that handles them according to your defined terms.

You can tailor the trust to meet your specific needs, such as choosing recipients and determining just how and when they receive circulations. In addition, overseas depends on often provide confidentiality, securing your economic events from public examination. By comprehending these basics, you can make informed choices concerning whether an overseas count on aligns with your asset protection strategy and long-term economic objectives. Comprehending this tool is a crucial action towards protecting your riches.

Legal Defenses Provided by Offshore Trusts

When you develop an offshore depend on, you're taking advantage of a robust structure of legal securities that can shield your properties from various threats. These counts on are frequently controlled by beneficial regulations in offshore jurisdictions, which can provide more powerful defenses against financial institutions and legal cases. For instance, several offshore trust funds gain from legal protections that make it hard for financial institutions to access your possessions, also in personal bankruptcy scenarios.

Furthermore, the separation of legal and helpful possession means that, as a beneficiary, you do not have straight control over the possessions, making complex any kind of attempts by lenders to take them. Several offshore territories additionally restrict the time frame in which asserts can be made against trust funds, including one more layer of protection. By leveraging these legal protections, you can significantly improve your monetary stability and secure your riches from unanticipated hazards.

Personal Privacy and Discretion Conveniences

Developing an offshore depend on not just uses robust legal protections but also guarantees a high degree of personal privacy and privacy for your possessions. When you established an offshore trust, your financial events are secured from public examination, assisting you maintain discernment concerning your riches. This privacy is necessary, particularly if you're concerned about possible legal actions or undesirable interest.

In numerous offshore territories, regulations shield your individual info, indicating that your properties and economic transactions continue to be private. You won't need to stress over your name showing up in public records or financial disclosures. In addition, collaborating with a reliable trustee guarantees that your information is taken care of firmly, additional enhancing your personal privacy.

This level of discretion enables you to handle your riches without fear of direct exposure, providing comfort as you protect your economic future. Eventually, the personal privacy benefits of an overseas trust can be a substantial advantage in today's significantly transparent world.

Tax Benefits of Offshore Trust Funds

One of the most engaging reasons to consider an overseas depend on is the potential for considerable tax advantages. Establishing up an offshore count on can aid you minimize your tax liabilities legitimately, depending upon the territory you pick. Many offshore jurisdictions use favorable tax rates, and sometimes, you might even gain from tax obligation exemptions on income produced within the depend on.

By transferring possessions to an overseas trust, you can separate your personal riches from your taxed earnings, which might reduce your general tax obligation problem. In addition, some territories have no funding gains tax, allowing your investments to grow without the immediate tax implications you 'd face domestically.

Asset Diversification and Financial Investment Opportunities

By creating an offshore depend on, you open up the door to asset diversity and distinct financial investment chances that might not be available in your home nation. With an offshore count on, you can access various international markets, allowing you to buy actual estate, stocks, or products that could be restricted or less favorable locally. This global reach helps you spread risk throughout various economic climates and markets, shielding your wealth from local economic declines.

Moreover, overseas counts on frequently give accessibility to specialized investment funds and different assets, such as exclusive equity or hedge funds, which might not be readily available in your home market. This calculated approach can be essential in protecting and expanding your riches over time.

Sequence Planning and Wide Range Transfer

When considering just how to pass on your wealth, an overseas trust can play an important duty in efficient sequence planning. By developing one, you can guarantee that your properties are structured to attend to your enjoyed ones while reducing potential go to this website tax obligation ramifications. An offshore trust enables you to determine just how and when your beneficiaries get their inheritance, supplying you with assurance.

You can designate a trustee to take care of the trust fund, assuring your wishes are accomplished even after you're gone (offshore trusts asset protection). This setup can also safeguard your properties from financial institutions and lawful difficulties, safeguarding your household's future. Furthermore, overseas trust funds can offer privacy, keeping your financial matters out of the public eye

Eventually, with cautious preparation, an overseas trust fund can offer as an effective device to facilitate wealth transfer, guaranteeing that your legacy is preserved and your loved ones are looked after according to your desires.

Selecting the Right Jurisdiction for Your Offshore Depend On

Picking the right jurisdiction for your offshore count on is a crucial consider optimizing its advantages. You'll intend to contemplate elements like lawful structure, tax obligation implications, and possession defense regulations. Different jurisdictions provide differing degrees of confidentiality and stability, so it is critical to research each alternative extensively.

Seek areas recognized for their favorable depend on legislations, such as the Cayman Islands, Bermuda, or Singapore. These jurisdictions frequently provide durable lawful protections and a track record for monetary protection.

Additionally, think of accessibility and the convenience of managing your trust from your home nation. Consulting with a legal specialist concentrated on offshore trust funds can assist you in steering via these complexities.

Ultimately, selecting the optimal jurisdiction can improve your asset defense technique and assure your riches is guarded for future generations. Make notified choices to protect your financial tradition.

Frequently Asked Inquiries

Can I Set up an Offshore Trust Fund Without an Attorney?

You can technically set up an overseas count on without a legal representative, but it's high-risk. You might miss out on important legal subtleties, and problems can emerge. Employing a specialist guarantees your depend on abides by guidelines and shields your rate of interests.

What Occurs if I Relocate To An Additional Country?

Are Offshore Trusts Legal in My Nation?

You'll require to check your neighborhood legislations to identify if overseas trusts are website here legal in your nation. Rules vary widely, so speaking with a lawful professional can help ensure you make educated choices about your possessions.

Exactly How Are Offshore Trust Funds Regulated Globally?

Offshore trust funds are regulated by international legislations and standards, differing by territory. You'll locate that each country has its own guidelines pertaining to taxes, reporting, and compliance, so it's necessary to understand the specifics for your situation.

Can I Access My Possessions in an Offshore Depend On?

Yes, you can access your properties in an overseas depend on, yet it relies on the trust fund's framework and terms. You need to consult your trustee to recognize the certain procedures find more info and any kind of constraints entailed.

Verdict

To sum up, offshore trusts can be a clever selection for securing your riches. By using legal safeguards, privacy, and potential tax obligation advantages, they assist you safeguard your possessions and plan for the future. Plus, the possibility for diversity and international investments can improve your financial growth. When taking into consideration an offshore trust fund, make the effort to pick the ideal jurisdiction that lines up with your objectives. With the best technique, you can truly guard your monetary legacy - offshore trusts asset protection.

Report this page